When it comes to economic resurgence in post-COVID-19 world, West Virginia and Latin America have a lot in common. Despite challenges, certain regions and industries in West Virginia are showing signs of growth, similar to Latin America’s rising potential as a global market and symbol of economic recovery. This commonality underscores opportunities for trade and investment between West Virginia and Latin American countries.

Like West Virginia, Latin America has shown signs of growth, with most economies regaining their pre-pandemic sizes by the end of 2022, growing by 7 percent in 2021 and 3.9 percent in 2022. This bounce-back highlights the region’s dynamic market potential. As we enter 2024, Latin America presents a cautiously optimistic economic outlook, with a slight projected growth dip to 1.9 percent, which still points to opportunities compared to other global markets.

Because Latin America is made up of many diverse economies and cultures, successfully tapping into this growing market requires an understanding of the varied processes and regulations that govern commerce across its 33 countries. In this blog, we’ll highlight some of these key aspects, offering a few insights and examples to guide West Virginia businesses as they navigate trade in a region that is rapidly becoming a pivotal player in the global economic landscape.

Import and Export Documentation

Like any market, exporting your product to a Latin American country involves meticulous paperwork. This documentation not only serves to meet legal requirements but also plays a vital role in ensuring the smooth transit of goods across borders. For example, when exporting to a market as significant as Brazil, companies are required to furnish several key documents:

- Commercial Invoice: This document details a transaction between an exporter and importer and includes information like a description of the goods, value and involved parties.

- Packing List: This document complements the commercial invoice, providing detailed information about the packaging of the shipped goods, such as types, quantities and dimensions of packages.

- Bill of Lading: This document serves as a contract between the owner of the goods and the carrier, acting as a receipt for the shipped goods and outlines the terms of the transport agreement.

- Detailed Import Declaration: This document details the shipped goods, including their classification and valuation to determine applicable tariffs and taxes and ensure compliance with local trade regulations.

One other thing to consider: the process of preparing import and export documents often involves coordination with freight forwarders, customs brokers and legal advisors. Inaccuracies or omissions in these documents can lead to delays, fines, or even the seizure of goods, so make sure you are not only accurate but compliant in all of your paperwork.

Tariffs and Customs Duties

Navigating tariffs and customs duties is a key aspect of trading in Latin America, as each country has its own unique tariff structure that affects the cost and feasibility of exports. That’s why understanding Harmonized System Codes is essential. These codes classify traded products and determine the applicable duty rates and taxes, making accurate classification vital to avoid delays and penalties. Countries like Mexico, Brazil, Argentina and Colombia have distinct customs regulations and duty rates, influenced by factors like trade agreements and economic policies.

For businesses, particularly those in West Virginia looking to export to Latin America, understanding these tariffs and their application to specific products is essential for both legal compliance and strategic business planning. Proper management of these duties can result in significant cost savings and more competitive pricing. To navigate this complex landscape effectively, leveraging resources such as local trade experts, customs brokers, and updated trade databases is recommended. This proactive approach is critical for adapting to the dynamic tariff landscape and achieving long-term success in Latin American markets.

Compliance with Local Regulations

Local regulations play a significant role in successfully exporting your products to Latin America. For example, adherence to regulations set by the Argentine Food Safety Agency is essential for companies dealing with food and pharmaceutical products. Companies dealing in these sectors must navigate a complex regulatory environment, ensuring that their products meet all safety, quality and labeling standards. Non-compliance with these regulations can lead to severe consequences, such as the rejection of products at the border, financial penalties or even a ban on future imports.

Because laws and regulations can vary across the region, companies looking to enter or expand in the Latin American market should consider partnering with local experts or legal advisors who can provide crucial insights into the latest regulatory changes, assist in the compliance process and help navigate the unique challenges of each country’s regulatory landscape.

Documentation Translation and Notarization

When it comes to exporting, accurate translation and notarization of official documents are crucial steps. This requirement is especially important in countries where English is not the official language, as is the case with most Latin American nations. For instance, in Chile, all legal and commercial documents involved in trade, such as contracts, regulatory submissions, and legal correspondences, must be translated into Spanish. Once translated, these documents must be authenticated by a notary public to verify the accuracy of the translation and the identity of the signatories. This process ensures that the documents are legally valid and recognized by local authorities, which is essential for smooth business operations and legal compliance.

The translation and notarization processes are not mere formalities but critical components that guarantee the clarity, validity and legal enforceability of documents in international trade contexts. Partnering with reliable translation services and understanding the specific requirements of each country’s legal system can significantly streamline this aspect of trade, ensuring compliance and facilitating smoother interactions with local entities.

VAT and Taxation

Value Added Tax (VAT) and taxation policies vary across Latin American nations, so it is important that you understand the terms and conditions of such agreements, which can help streamline customs procedures and reduce tariffs. In Colombia, for example, the VAT rate for most goods is 19 percent. Understanding local tax obligations is not only crucial for compliance but also for financial planning and pricing strategies. Misunderstanding or overlooking VAT requirements can lead to significant financial setbacks, including penalties and interest on unpaid taxes.

Many Latin American countries also offer tax incentives and exemptions and have created special economic zones with various benefits to promote certain economic activities or to attract foreign investment. Staying informed about these incentives and how to qualify for them can provide a competitive edge for your company. Local tax advisors or consultants can provide up-to-date information on the tax landscape and assist in navigating the complexities of each country’s tax system.

Trade Agreements

Taking advantage of existing trade agreements is a strategic approach that can significantly streamline the trading process. These agreements often provide benefits such as reduced tariffs, simplified customs procedures and greater market access, which can be crucial for competitive pricing and efficient operations. A prime example is the United States-Mexico-Canada Agreement (USMCA), which enhances trade relationships among these North American countries.

Beyond the USMCA, the United States has other free trade agreements with several Latin American countries, including Chile, Colombia, Panama, Peru and the Dominican Republic as part of the Central America-Dominican Republic Free Trade Agreement. These agreements typically reduce barriers to U.S. exports, protect U.S. interests and enhance the rule of law in the FTA partner country. For example, the U.S.-Colombia Free Trade Agreement has provided significant benefits to U.S. agricultural and manufactured goods.

We help you navigate the world of exports

Venturing into Latin American markets requires a meticulous approach to navigate the intricate web of processes and regulations. West Virginia companies can enhance their chances of success by investing time in understanding the unique requirements of each country. Diligent attention to documentation, compliance with local regulations and staying abreast of tax and trade agreements are essential steps for a smooth and prosperous trade journey in Latin America.

Our team of trade experts can help you find customers in Latin America and create a plan for success in 2024. Contact us to schedule an export development meeting with one of our trade managers today!

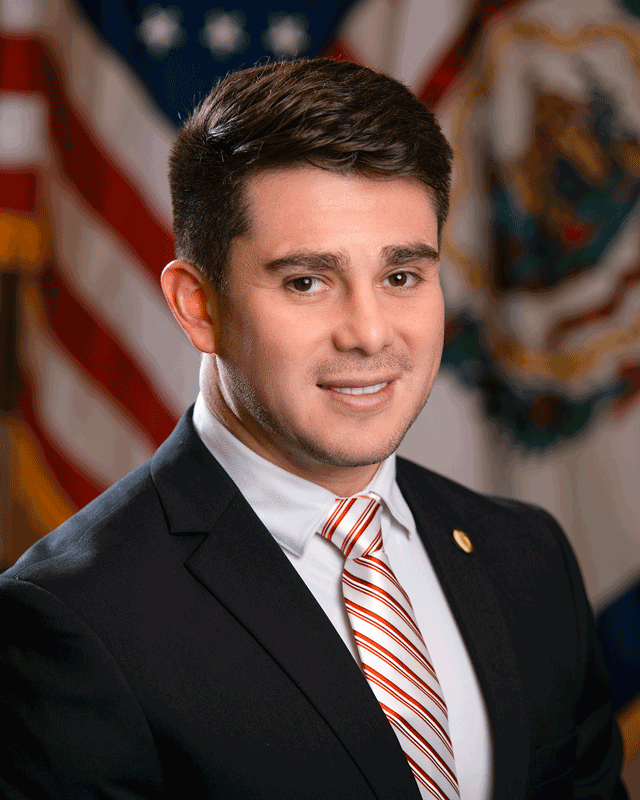

By Jesús Velasco Espín

International Trade Manager

A native of Mexico City, Mexico, Jesús is a graduate of West Virginia State University, where he earned a degree in Business and Economics. He’s currently finishing his MBA at the University of Charleston. He is fluent in Spanish and English and will be the primary Export Promotion Program contact for companies in Barbour, Brooke, Cabell, Calhoun, Doddridge, Gilmer, Hancock, Harrison, Jackson, Lewis, Marion, Marshall, Mason, Monongalia, Ohio, Pleasants, Preston, Ritchie, Roane, Taylor, Tyler, Wayne, Wetzel, Wirt and Wood counties. Contact Jesús at Jesus.Velasco@wv.gov.